Does pairs trading still work (if you’re not a hedge fund)? [2021]

![Does pairs trading still work (if you’re not a hedge fund)? [2021]](https://firemymoneymanager.com/wp-content/uploads/2021/01/screenshot-2021-01-26-10-15-40-800x391.png)

In this article, we will look at a popular algorithm for hedge funds and high-frequency traders called pairs trading. In its most basic form, you select a pair of stocks that historically move together and trade when they diverge. The expectation is that as they return to a normal state, you will make money.

This is still a workable strategy for high frequency hedge fund traders who can co-locate giant server farms in exchange datacenters, but can it still work for average traders who don’t have these resources? Or are all of these statistical arbitrage opportunities gone by the time an average trader can execute? Can this strategy be run at a daily/weekly frequency anymore or does it have to be run in milliseconds?

We will run some tests on the basic strategy to see if it can work today.

Historical profitability of pairs trading

Pairs trading has been in use for decades, and has been profitable — even at weekly frequencies. In 2006, a study was done by Yale on its effectiveness. The study is worth reading: Pairs Trading: Performance of a Relative Value Arbitrage Rule.

We find that trading suitably formed pairs of stocks exhibits profits, which are robust to

Pairs Trading: Performance of a Relative Value Arbitrage Rule

conservative estimates of transaction costs. These profits are uncorrelated to the S&P 500,

however they do exhibit low sensitivity to the spreads between small and large stocks and

between value and growth stocks in addition to the spread between high grade and intermediate

grade corporate bonds and shifts in the yield curve. In addition to risk and transactions cost, we

rule out several explanations for the pairs trading profits, including mean-reversion as previously

documented in the literature, unrealized bankruptcy risk, and the inability of arbitrageurs to take

advantage of the profits due to short-sale constraints.

However, this study does find that opportunities are much less frequent and much less profitable in 2000- timeframe.

One view of the lower profitability of pairs trading in recent year is that returns are

Pairs Trading: Performance of a Relative Value Arbitrage Rule

competed away by increased hedge fund activity. The alternative view, taken in this paper, is that

abnormal returns to pairs strategies are a compensation to arbitrageurs for enforcing the “Law of

One Price”.

Building a pairs trading model

To determine whether pairs trading still works, we will model a basic pairs trading strategy in Python using historical data, and then see if we can use that strategy to generate excess return in the next period.

We will use a lot of loading code that we wrote in the Getting Started article, which you should read before this one.

Our first task is loading the data. Our data comes from Quandl in a set of CSV files. We will load them all into a DataFrame using pandas:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import quandl

import pickle

import csv

import os

from datetime import date

import sys

import statsmodels.api as sm

import scipy.optimize as sco

plt.style.use('fivethirtyeight')

np.random.seed(777)

alldata = pd.DataFrame()

try:

ticker_data = pd.read_csv("tickers.csv")

except FileNotFoundError as e:

pass

for t in ticker_data['ticker']:

try:

data = pd.read_csv("d:\\stockdata\\" + t + ".csv",

header = None,

usecols = [0, 1, 12],

names = ['ticker', 'date', 'adj_close'])

alldata = alldata.append(data)

except FileNotFoundError as e:

pass

Our ticker CSV file contains a lot of tickers that we don’t want to look at, such as delisted ones and OTC stocks, so we will filter it before loading:

ticker_data = ticker_data.loc[(ticker_data['table'] == 'SF1') & (ticker_data['isdelisted'] == 'N') & (ticker_data['currency'] == 'USD') & ((ticker_data.exchange == 'NYSE') | (ticker_data.exchange == 'NYSEMKT') | (ticker_data.exchange == 'NASDAQ'))]

Now, we have all of the relevant tickers in a DataFrame. The next step is cleaning the data so that we can build a correlation matrix. We will use daily data at first. Later, we can move to longer timeframes.

df = alldata.set_index('date')

table = df.pivot(columns='ticker')

table.columns = [col[1] for col in table.columns]

table.index = pd.to_datetime(table.index)

table = table['2018-01-01':'2020-01-01']

table = table.loc[:, (table.isnull().sum(axis=0) <= 30)]

table = table.dropna(axis='rows')

Finally, generating a correlation matrix is very simple with Pandas:

A AAL AAME AAN AAON AAP AAPL \

A 1.000000 -0.411075 -0.423860 0.548792 0.677535 0.439531 0.515594

AAL -0.411075 1.000000 0.762728 -0.675839 -0.625932 -0.729448 -0.526901

AAME -0.423860 0.762728 1.000000 -0.544478 -0.579686 -0.578142 -0.637582

AAN 0.548792 -0.675839 -0.544478 1.000000 0.857118 0.498967 0.648432

AAON 0.677535 -0.625932 -0.579686 0.857118 1.000000 0.484853 0.624596

... ... ... ... ... ... ...

ZIOP 0.296149 -0.085815 -0.192385 0.472562 0.574997 -0.224872 0.353245

ZIXI 0.440557 -0.699289 -0.566404 0.679136 0.761478 0.583238 0.284436

ZNGA 0.631641 -0.730482 -0.702510 0.844649 0.898749 0.453662 0.625134

ZUMZ 0.562601 -0.421862 -0.498312 0.619821 0.548948 0.285115 0.796054

ZVO -0.423629 0.493856 0.469000 -0.674794 -0.682076 -0.058555 -0.525241 Finding pair trading opportunities

With the correlation matrix, we can get a lot of information. Using a simple sort, we can get the top correlations:

XEL AEP 0.996523

V MA 0.994791

NEE ETR 0.994646

WEC XEL 0.994444

OPTT AEE -0.972316

SHIP AMT -0.972656

SO DYNT -0.972725

AEE FCEL -0.973476

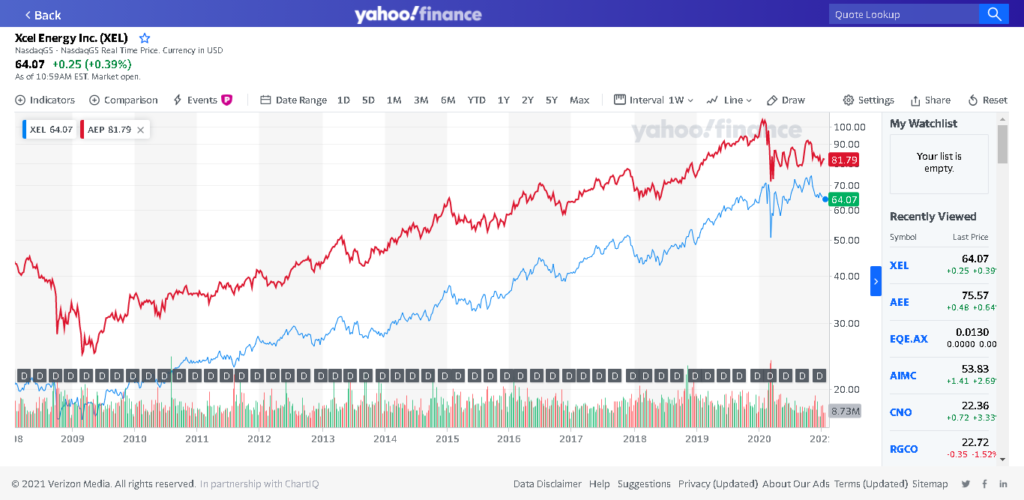

OGE OPTT -0.976275As we can see, this is consistent with what the paper found: the most correlated stocks are for energy companies. Let’s look at one of these on a chart:

To determine the signal for when a trade should occur, we look at the difference between the two stocks:

In [22]: diff = table['XEL']-table['AEP'] In [23]: diff.mean() Out[23]: -24.10590632758745 In [24]: diff.std() Out[24]: 3.148618069119123

Now, we can say with a reasonably high level of confidence that if the two stocks diverge by more than 2 standard deviations (or ~ 6.3), there is a trading opportunity. Let’s see if that happens in the period following this one:

> next_period = df.pivot(columns='ticker')

> next_period.columns = [col[1] for col in next_period.columns]

> next_period.index = pd.to_datetime(next_period.index)

> next_period = next_period['2020-01-01':]

> next_diff = next_period['XEL']-next_period['AEP']

> next_diff.loc[next_diff < -30.4]

date

2020-01-15 -30.736753

2020-01-16 -30.877687

2020-01-17 -31.762922

2020-01-21 -31.903163

2020-01-22 -32.340503

2020-01-23 -32.607094

2020-01-24 -33.502785

2020-01-27 -33.378315

2020-01-28 -33.482761

2020-01-29 -33.890905

2020-01-30 -33.828830

2020-01-31 -33.521868

2020-02-03 -33.265412

2020-02-04 -32.095119

2020-02-05 -31.362759

2020-02-06 -30.806166

2020-02-07 -31.866599

2020-02-10 -32.091640

2020-02-11 -32.485245

2020-02-12 -31.993412

2020-02-13 -32.256399

2020-02-14 -32.717131

2020-02-18 -32.389837

2020-02-19 -31.938717

2020-02-20 -30.955869

So according to the pairs trading algorithm provided, we would open the trade on January 15, 2020 (XEL @ 63.59, AEP @ 94.33). The algorithm closes the trade when the two stocks cross their mean difference again. This happens on March 11, 2020 (XEL @ 65.90, AEP @ 88.21). This trade would therefore earn us $8.43, ignoring transaction costs.

A real test of the pairs trading algorithm

So in the one example, we did earn a positive return by following the pairs trading algorithm. The question is: does this generalize, and can we beat the market with this strategy? We will now look at a much larger number of correlated pairs.

First, we need to codify the trading algorithm. For readability, we will iterate over the DataFrames, although in practice there are much better ways to do this. We define a function to calculate per-trade profit

def calc_trade_profit(ticker1, ticker2, start_date, end_date):

if next_period.loc[start_date][ticker1] > next_period.loc[start_date][ticker2]:

high_ticker = ticker1

low_ticker = ticker2

else:

high_ticker = ticker2

low_ticker = ticker1

short_profit = next_period.loc[start_date][high_ticker] - next_period.loc[end_date][high_ticker]

long_profit = next_period.loc[end_date][low_ticker] - next_period.loc[start_date][low_ticker]

return long_profit + short_profit

Now, we iterate over each day in the period. For each day, we will iterate over the correlated pairs to find whether they trade on that day. If the difference between the prices of the two stocks is greater than the threshold (and was less yesterday), we open the trade. If the trade is open, and the difference between the prices goes below the mean, we close the trade.

Here’s our code:

print("starting trades")

for index, row in next_period.iterrows():

# iterate over the days of the next period

for sindex, srow in corrdata.iterrows():

# iterate over the correlated pairs

ticker1 = sindex[0]

ticker2 = sindex[1]

trade = ticker1 + '-' + ticker2

mean = srow['mean']

std = srow['std']

if not trade in trades:

trades[trade] = { 'open' : False, 'start' : None, 'earned' : 0. }

threshold = abs(mean) + 2*std

print(trade + " " + str(row[ticker1]) + " " + str(row[ticker2]) + " " + str(threshold) + " " + str(abs(row[ticker1] - row[ticker2])))

if ticker1 in prevrow:

if abs(row[ticker1] - row[ticker2]) > threshold and abs(prevrow[ticker1] - prevrow[ticker2] <= threshold):

#open a trade if not open

if not trades[trade]['open']:

print("opening trade " + ticker1 + "-" + ticker2 + ": " + str(index))

trades[trade]['start'] = index

trades[trade]['open'] = True

if abs(row[ticker1] - row[ticker2]) < abs(mean) and abs(prevrow[ticker1] - prevrow[ticker2]) >= abs(mean):

#close an open trade

if trades[trade]['open']:

print("closing trade " + ticker1 + "-" + ticker2 + ": " + str(index))

trades[trade]['earned'] = trades[trade]['earned'] + calc_trade_profit(ticker1, ticker2, trades[trade]['start'], index)

trades[trade]['start'] = None

trades[trade]['open'] = False

prevrow = row

Finally, we need to close all open trades on the last day (these are the ones that may be losers):

#now close all of the open trades on the last day of the period

last_day = next_period.index[-1]

for sindex, srow in corrdata.iterrows():

# iterate over the correlated pairs

ticker1 = sindex[0]

ticker2 = sindex[1]

trade = ticker1 + '-' + ticker2

if (trade in trades) and (trades[trade]['open']):

print("last day: closing trade " + ticker1 + "-" + ticker2)

trades[trade]['earned'] = trades[trade]['earned'] + calc_trade_profit(ticker1, ticker2, trades[trade]['start'], last_day)

trades[trade]['start'] = None

trades[trade]['open'] = False

print("total earned: " + str(functools.reduce(lambda acc,v: acc+trades[v]['earned'], trades, 0)))

Now, we run this algorithm on the top 100 correlated pairs:

XEL AEP 0.996523

V MA 0.994791

NEE ETR 0.994646

WEC XEL 0.994444

CMS 0.994384

SUI ELS 0.993536

CMS XEL 0.993018

AWK XEL 0.992827

UDR AVB 0.992741

AIV 0.992524

WEC AWK 0.992214

HE AEP 0.992158

SUI ETR 0.991948

MAA 0.991770

CMS LNT 0.991266

ADC O 0.991101

HE XEL 0.991046

OPTT FCEL 0.990808

AON AJG 0.990615

WELL PEAK 0.990414

AIV AVB 0.990408

TRNO PLD 0.990302

NEE LNT 0.990216

AEP AWK 0.989953

POR AEP 0.989822

CMS AEP 0.989687

O AIV 0.989058

UDR 0.989025

POR XEL 0.988931

PEAK O 0.988882

DRE EGP 0.988872

SO ETR 0.988799

DRE FR 0.988766

AWK AMT 0.988565

PNM XEL 0.988536

HE AWK 0.988447

ELS ETR 0.988435

O NNN 0.988409

EGP ELS 0.988395

MSFT V 0.988302

SUI NEE 0.987992

CMS POR 0.987979

CVV BLIN 0.987850

OGE AEE 0.987712

AEP WEC 0.987688

CMS AWK 0.987651

TRNO SUI 0.987628

PEAK ADC 0.987585

LNT ETR 0.987326

AEP PNM 0.987310

PEAK UDR 0.987200

POR AVB 0.987179

AVB CPT 0.987089

EQR ESS 0.986930

LNT WEC 0.986684

USM TDS 0.986674

WPC PSB 0.986629

NWE DTE 0.986558

CPT EQR 0.986507

AEE DTE 0.986407

XEL AMT 0.986397

EGP SUI 0.986270

ATO CMS 0.986256

NEE FE 0.986243

AEE NWE 0.986101

CMS EQR 0.986014

EGP STWD 0.985946

MA MSFT 0.985910

CMS FE 0.985907

NWE POR 0.985815

NEE ELS 0.985728

CCI AMT 0.985701

MT HAL 0.985365

EQR UDR 0.985344

MAA ETR 0.985262

MPW O 0.985165

EQR AVB 0.985094

BAH ARCC 0.984924

MA FICO 0.984884

HE WEC 0.984878

AEP AMT 0.984747

SUI SO 0.984630

NEE SO 0.984616

WEC ETR 0.984588

PNM AWK 0.984569

FR TRNO 0.984532

HE PNM 0.984259

BKH NWE 0.984165

STE BAH 0.984014

AWR WEC 0.983979

V ARCC 0.983937

UDR ADC 0.983922

MAA TRNO 0.983697

PSB WELL 0.983626

MAA NEE 0.983566

VRSK MSI 0.983533

BAH V 0.983492

HE AMT 0.983375

AWK POR 0.983327

FE LNT 0.983292Results of the pairs trading algorithm

From the period of January 1, 2020 to August 18, 2020, the algorithm would have earned a profit of $284, by trading one long and one short share at each signal. Since each long is paired with a larger short, you could achieve this with essentially $0 initial investment (ignoring trading costs), making the return essentially infinite. Moreover, if you run the model from January 1, 2020 to April 1, 2020, you would have seen a significant profit, even while the S&P 500 had dropped by almost 25%.

However, in reality, whenever you open a short position, you assume a liability.

Conclusion: does pairs trading still work in 2021?

Our model shows that pairs trading can work and be profitable in 2021. The question of how profitable, and whether it is worth the risk is something we will tackle in a future article.

No Comments